Decoding DEX Users

With the upcoming deployment of Uniswap v4, it becomes crucial to delve deep into the behavior of decentralized exchanges (Dex) users.

This analysis aims to provide valuable insights to web3 growth teams, equipping them with knowledge about acquisition channels, user stickiness, migration between platforms, and the Customer Lifetime Value (CLV) of Dexes.

Dex Users Survey

To gain comprehensive insights into Dex users, an incentivized survey was conducted on Tide. Eligibility for participation required users to have a minimum of 5 transactions on Dexes, with 3 $ARB distributed upon survey completion. The survey garnered 100 responses, yielding key takeaways that shed light on Dex users’ behavior.

Acquisition Channels:

Twitter, Discord, and various other media platforms (e.g., Messari, Cointelegraph) emerged as the primary awareness channels where new projects are discovered.

Quest and community platforms (such as Galxe, Layer3, and Tide) ranked below content but ahead of Google search in terms of user discovery.

2. Wallet Per User:

The majority of users consistently utilize fewer than five wallets, with an average of 4.1 wallets per user and a median of 3.

3. Price Sensitivity and Multiple Dex Usage:

Unsurprisingly, dex users exhibit price sensitivity, considering price/fees as the most important feature.

Nearly 60% of users check multiple Dexes or aggregators before executing a trade.

4. Uniswap Dominance:

Uniswap remains the dominant Dex, with over 60% of users considering it their default go-to platform.

Dex and aggregators Users Migrations

To assess user stickiness, migrations between selected Dexes on

Arbitrumwere analyzed. Wallets with over 100 transactions were excluded from the analysis. The migration chart reveals insights into user retention and stickiness.

Retention Measure: The diagonal line represents the likelihood of the next transaction occurring on the same Dex. Dexes like1inch Network,Trader Joe, and Uniswap exhibit similar retention rates.Camelot DEXshows slightly higher retention, possibly due to its offering of unique tokens during launch phases.

Curve’s retention rate is comparatively lower, which aligns with the limited coverage of pairs/tokens. As anticipated, most users migrate from Curve to Uniswap.

Dex users, overall, demonstrate high retention and stickiness, with four Dexes exhibiting approximately 90% retention rates, surpassing bridges by a significant margin.

A Customer Lifetime Value model for Uniswap

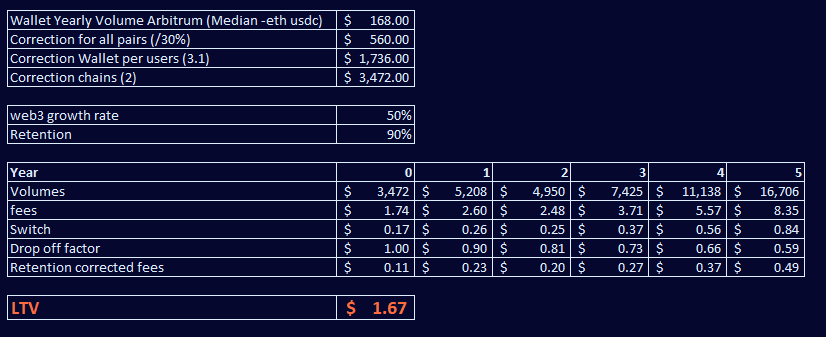

The CLV of a Dex user is a vital metric to gauge their long-term value. The CLV for Uniswap users was computed using a simple formula, considering volume, protocol fees, web3 Compound Annual Growth Rate (CAGR), and retention rate.

Let’s compute it on Uniswap data, using this simple formula

Where

Volume: Dex volume in the first year, aggregating all user wallets

fee: the protocol fee. We assume that the fee switch will collect 10% of liquidity provider fees

g: the web3 CAGR (50%) to account for increasing volume

r: the yearly retention rate — assumed 90% based on the migration chart above

The computed CLV for Uniswap users using the $ETH/$USDC (0.05%) pool on Arbitrum amounted to approximately $1.7 per user. This value is significantly lower than the amount distributed through airdrops (approximately $2,000 per eligible wallet). Wallets with volumes lower than $5 were excluded from the analysis.

This is a very rough measure to help protocols manage their marketing budget efficiently and put an upper bound to the CAC (Customer Acquisition Cost).

There are three main considerations here:

Low CLV: The CLV for Dex users, particularly when compared to traditional finance (Tradfi), fintech, and centralized exchanges (Cexes), is relatively low. This is primarily due to the low protocol fees assumed after the fee switch (0.005%). Dexes that are not dominant should focus on identifying new revenue streams.

The most important variable under the control of protocols is retention. CLV is exponentially increasing with retention. Retention is a product problem, but crypto allows to run frontier campaigns to identify the best wallets and provide personalized and cashback-like (meaning, with negative ROI for sybils) rewards to boost it. Tide can help.

LTV follows an exponential distribution, like volumes. In practice, very few wallets bring a disproportionate amount of fees — while the rest has a very low LTV. Web3 businesses need to differentiate LTV and CAC according to their user base for more effective campaigns

You can read the full analysis here.

Last updated